Healthcare Revenue Cycle Management (RCM):Healthcare RCM M&A Market Extremely Active in 2021

By CAS January, 2022

The Healthcare RCM M&A market generated 75 transactions in 2021 representing approximately $30 billion in deal value. While the majority of deal value was generated by handful of billion dollar plus deals, there was a wide range of companies acquired in terms of deal value by both financial and strategic buyers. In short, healthcare RCM is still considered a highly attractive M&A market (1), particularly for businesses that are focused on the early part of the healthcare RCM cycle (pre-registration/registration, patient eligibility, insurance verification/follow up) and complex claims (worker’s comp, third party liability, denial claims management).

Regulation F caused some disruption (2) within the healthcare industry, predominantly because certain healthcare providers needed assistance from their RCM vendors to be properly prepared for its implementation. While it is too soon to predict the future impact of Regulation F on this industry, we have begun to see how buyers are reacting to this issue. Many buyers are incorporating a review of a company’s compliance policies and procedures specifically pertaining to Regulation F in their confirmatory due diligence. We have not yet seen a situation where an issue has been raised that impacted a transaction, but we are expecting some dynamics to unfold as the year progresses, particularly if a seller has any pending legal cases pertaining to a potential Reg F violation.

Technology Investment is Industry’s Best Bet

With visits down, staffing issues rampant, and costs continuing to rise, the healthcare industry is clamoring for innovative digital solutions to combat issues from both sides.

A. COVID-19’s Impact on the Health Industry

COVID-19’s overall impact on healthcare industry has been a constantly evolving phenomenon. One of the biggest changes has undoubtedly been workforce shortages and the continuing trends of supply chain issues related to medical supplies and equipment. According to the Bureau of Labor Statistics, through September 2021, hospital employment has decreased by 93,000 since the start of the pandemic. Those numbers continue to stagger, with an 8,100 reduction in just the month of September.

There are new implications we are seeing because of increased recruiting gimmicks. According to a recent HMFA article, traveling nurses are making a premium to make the trip to areas in the most need, leading to massive pay discrepancies between people working side by side in the hospitals that these nurses are sent to. Additionally, smaller, and more rural hospitals can’t afford the increased pay to replace lost employees or to supplement with contract workers. The increased costs associated with staffing hospitals and offices, is leading to a decrease in available budget for other important areas such as technology and innovation.

Another continued trend we are seeing is increased out-of-pocket costs for patients and decreased availability of appointments among healthcare providers. Overall patient visits continue to be down, most notably in the dental health sector. A recent Gallup poll shows that one in three American’s have forgone medical care during the pandemic due to the costs associated with the medical care they required. Targeted efforts will be needed to be made to avoid exacerbating socioeconomic inequities that have resulted in the past couple of years.

These trends will continue in 2022 as we begin to see how long-term these impacts will be on the healthcare industry. According to the Association of American Medical Colleges, between 37,800-124,000 is the expected shortage projection of physicians by 2034. According to Mercer, the projected shortage of support staff, such as medical assistants and home health aides, will reach 3.2 million by just 2026.

B. COVID-19 Claims – Denials Management

“In the first ten months of 2021, 40% of COVID-related charges were denied, and high rates of errors were found with bundling of claims.” Hospitals and other health care providers continue to be negatively impacted by billing errors which are causing increased rates of insurance claim denials. Undercoding seems to be the culprit for most of the revenue risk.

According to the Healthcare Auditing and Revenue Integrity: 2021 Benchmarking and Trends Report, two major contributors to these issues are a lack of auditing and proper training for providers and coders. Healthcare providers should look to approach issues around revenue and compliance through a “unified revenue integrity-based approach,” says Peter Butler, CEO of Hayes Technology. “By expanding the scope of audits to incorporate risk-based and prospective audits, organizations can increase the impact of their compliance programs by more rapidly identifying and addressing risk, resulting in improved revenue flow and reduced risk of takebacks.”

With increasing claim denials likely to continue, we expect to see more service providers outsourcing this function to 3rd party companies. The volume of denials with continue to push hospitals and others in the healthcare industry to move in this direction as they won’t be able to supplement their administrative staff to accommodate.

C. Explosion in Telehealth Medicine

In this post-COVID environment people want fast, easy options, with more transparent pricing when it comes to their health care providers. The explosion of telehealth is continuing to increase in popularity and is now becoming a permanent fixture, as well as self-scheduling with real-time availability.

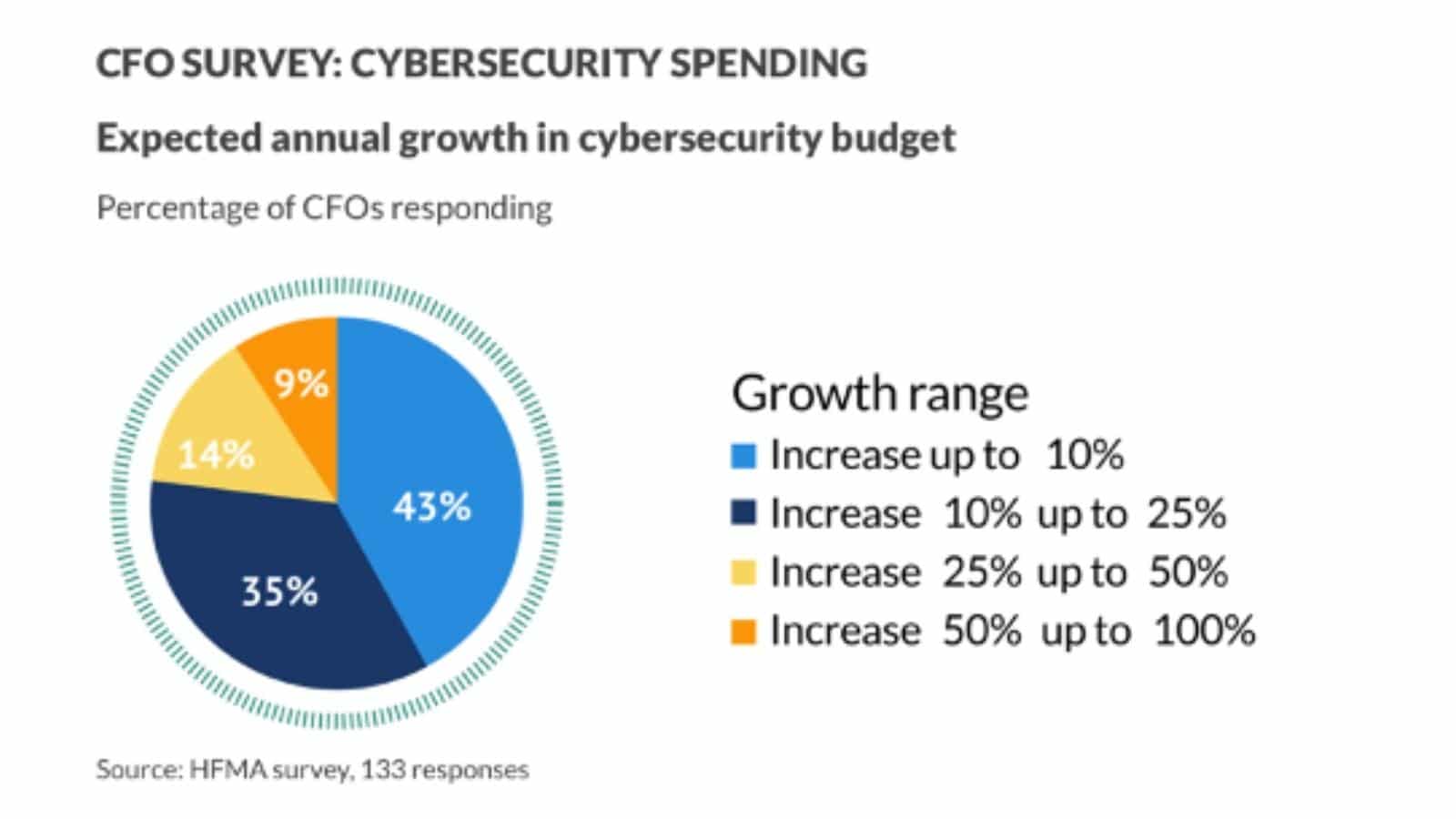

Healthcare is finally going digital, and the implications have created a balancing act for providers to figure out between offering advanced digital options to their patients and protecting and securing their personal and health information. Healthcare companies will either need to invest in their own digital platforms or leverage software solutions form third-party providers that can accommodate their needs. With this added investment comes an additional need to increase spend in cyber security as noted in the table below.

Data-driven digital health strategies will remain at the forefront, driving faster innovation and more customized options to accommodate changing behaviors and needs of patients. With a new generation of patients influencing the industry, a shift towards pro-active health management and more choice when it comes to care providers are the largest changes that we are seeing. Disrupters in the industry such as Amazon Care are making the urgency to adapt to the changing landscape that much more critical. Value-based care models are growing in popularity as we expect to see more venture-capital-funded companies attempting to attract patients away from traditional health care providers.

A. Administrative Labor shortage – Outsourcing on the Rise

As labor shortages impact most industries, the healthcare industry has been devastated, not only in clinical roles, but across all the administrative functions too. The implications of this have led to delays in billing cycles, increased errors, and ultimately, revenue risk for healthcare providers. To combat these increasingly significant issues some are looking to cloud-based infrastructure, process automation, productivity improvements, and better analytics. However, the number one trend that we see is outsourcing.

More hospitals and healthcare providers will look to address growing issues with billing upfront. This means correcting data problems by improving the registration process and setting proper financial expectations with patients from the start. By providing accurate and timely estimates before care is provided, this will lead to less billing and collection related issues afterwards.

B. Predictions for 2022

With inflation on the rise, the impact to the healthcare industry could be severe. Rising prices due to supply chain issues and insurance costs will continue to force providers to charge more for their services. Those that prosper in these market conditions will be those that can utilize innovative technology solutions to provide telehealth services and cater to the changing needs of the public. We can expect to see more outsourcing as RCM companies look to diversify their workforce internationally while also catering to the growing demand for hybrid work models.

From an M&A perspective, we anticipate 2022 to be an active M&A market predominantly driven by larger public and private equity backed buyers acquiring smaller healthcare RCM companies. Buyers will be motivated to acquire market share, access to new regions, services and technology. Sellers will be motivated to maximize value and in some cases merge with larger healthcare RCM company to achieve stronger performance and exit options at some point in the future.

(1) Source HFMA

(2) Source ACA, HFMA