ACCOUNTS RECEIVABLE MANAGEMENT (ARM): ARM M&A Market To Remain Active in 2022

By CAS January, 2022

Throughout 2021, the ARM industry experienced an active M&A market, with 21 deals completed representing almost $1.2 billion in total deal value. These results were driven predominantly by larger industry buyers acquiring smaller players, highlighted by Transworld Systems Inc. (TSI), who acquired the collection division of Performant (NASDAQ: PFST), Account Control Technologies (ACT) and the U.S. ARM division of EOS. 2021 deal activity was also supported by strategic and financial buyers, including FirstSource’s strategic acquisition of ARSI, Tonka Bay’s recapitalization of Professional Credit, Security Credit Services acquisition of Jormandy and Indebted’s acquisition of Delta Outsource Group.

We noticed in the second half of the year an increase in the use of deal structure (seller notes, earn outs, etc.), primarily driven by uncertainty around future business performance due to the tapering off of stimulus funding, and potential declines in consumer spending driven by inflation, tax increases, and challenges impacting global supply chain/distribution systems.

We anticipate more ARM companies seeking to merge or sell in 2022, particularly post tax return season. This prediction is driven by the challenges that certain ARM companies, particularly smaller/mid-sized companies, experienced in the second half of ’21, and what we believe will be an underwhelming tax return season. While many ARM companies will fight to survive and evolve, others will make the choice to merge or sell. Companies that do decide to sell in ’22 will have multiple buyer prospects in most cases but may need to accept normalized market valuations that incorporate some form of structure in order to consummate a deal. This structure will be used to bridge valuation gaps between the buyers and the sellers – sharing the risk of future market uncertainty. However, those ARM companies that are bucking the trends (continue to experience top and bottom-line growth, have invested in non-voice and other technology enhancements, maintain client/servicing diversification, etc.) will be more attractive and generate more aggressive market valuations with less structure.

Technology solution providers will also continue to attract attention from strategic and financial buyers in 2022. Recent transactions such as Solutions By Text’s $35 million growth investment by Edison Partners and Katabat’s acquisition by Ontario highlight financial and strategic buyer interest in the technology sector.

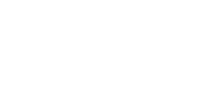

The below chart shows a breakdown of which expenses ARM company executives/owners predict will increase/decrease over the next two years. As expected, technology solutions, marketing, compliance management systems, and employee compensation are among the top expense increase predictors.

A. What’s the Deal with Debt?

Despite the economic stimulus packages, consumers have less savings to fall back on, especially those working in the harder hit industries, then they did prior to the pandemic. As we head into tax season, people who have already received child tax credit payments will need to be cognizant of how that will impact their return. This will undoubtedly impact the ARM industry and the constituents’ overall ability to collect on debts.

According to the TransUnion 2021 – A Transition to New Normal Report, the number of consumers with a collection tradeline in their credit file is down in 2021. “At the end of Q3 2021, 77.6 million consumers had at least one collection tradeline, collectively totaling $188 billion in outstanding balances — a 1% and 3% decline, respectively, from year-end 2020. As in previous years, healthcare, financial services and utility/telecom accounts make up a significant share of debts in collection.”

As stated in the 2021 Financial Stability Oversight Council annual report, the household debt ratio has remained low due to rising incomes and low interest rates. Also, Americans are “feeling” richer due to the increased equity in their homes and stock market performance. Consumer credit (credit cards, auto loans, installment loans, and student loans) presents roughly 25% of total household debt. While stimulus payments have helped decrease certain types of debt (e.g., credit card debt), certain relief programs put in place during the pandemic have led to increases in other types of debt (e.g., auto and student loan balances). Regarding mortgages, it is likely we will see delinquencies on the rise and an increase in evictions in 2022.

B. Debt sales remain low

Throughout 2021, the ARM industry experienced lower volumes of charged off revolving consumer credit, resulting in less debt going to collections or being sold to 3rd party debt servicing of buying markets. Debt buyers haven’t been able to buy as many accounts because there aren’t as many being sold by creditors. Consumers have been paying down their debts with stimulus payments, so while liquidations have been high new placement volumes are lower. However, according to Kaye Dreifuerst, President of Security Credit Services, “We anticipate delinquencies and charge offs to increase again in Q2 and Q3 of this year as stimulus funding tapers off and consumers are faced with higher prices for goods and services and tax rates increase.” That should lead to larger volumes of debt sales toward the end of 2022 into 2023.

C. Regulation F Impact

The CFPB’s Regulation F went into effect on November 30th, which provided additional protections to consumers with alleged debts in collection. This caused a scramble to seek understanding and become educated on what implications this has on the industry as a whole and companies individually. The main changes that came with this new regulation were giving the consumers the right to stop collection calls, preconditions to collector credit reporting, limits on the frequency of collection conversations, and expanded information on required debt collection notices.

With this new regulation still fresh for many, it is critical for companies to continue to educate themselves on the implications, while leveraging technology to put these new standards into practice for their collectors. We expect to see increased spend in technology solutions that provide efficiency within outbound communications to increase collection rates while complying with the new policies. This will undoubtedly add to consolidations within the ARM industry as costs continue to be a barrier for smaller agencies. (See table below from the AiteNovarica – A Transition to the Next Normal 2021 Report).

The biggest challenges this regulation posed for companies were around compliance, training, and adaption within existing systems and processes. For example, the 7x7x7 rule which limits the frequency that a consumer can be contacted needed to be implemented in collection systems. Ensuring that collectors do not contact consumers within the new allotted time meant changes to system notifications, training of employees to understand the new rule, and improved tracking to prove compliance with the regulation.

While it’s difficult to predict the financial impact of Regulation F on the ARM industry, it may lead to an increase in legal activity against ARM and OBS companies. According to Manny Newberger, Founding Shareholder and VP of Barron & Newberger, “The industry spent 2021 getting ready for Reg. F. We will spend 2022 finding out how well the consumer bar thinks everyone did and 2023 finding out how well the courts think everyone did.” In other words, this could turn out to be a challenging year for companies who have not been proactive in getting their businesses, and their clients, prepared for Regulation F.

D. Student Loan Changes

In October of 2021, Maximus replaced Navient as the government contractor for loan servicing of 5.6 million Department of Education-owned student loan accounts. Federal Student Aid Chief Operating Officer, Rich Corday commented, “We are confident this decision is in the best interest of the approximately 5.6 million federal student loan borrowers who will be serviced by Maximus and will provide the stability and high-quality service they deserve. Our confidence in this novation is bolstered by the fact that Maximus will be held to the stronger standards for performance, transparency, and accountability that FSA included in its recent servicer contract extensions.”

This change comes on the heels of nearly two years of debt collectors being prohibited to contact student loan interest and payments because of COVID-19, a hold that put some collection agencies out of business. The current administration just extended the moratorium on student loan payments until May of 2022, as the omicron variant and rising inflation rates pose more economic threat. This extension means that more than 40 million borrowers do not have to resume their monthly payments until the middle of this year.

Come this May, it is likely consumers will have to finally begin paying back their student loans. This will reduce disposable income for some consumers, and likely increase the number of student loan defaults.

E. Labor shortage

We’ve heard a lot over the past year about labor shortages as most chalked the cause up to repercussions from the year’s stimulus packages. However, young people opting to stay home and live off their unemployment and child tax credits isn’t really the cause for the lack of workforce plaguing many industries. According to November 2021’s numbers, 3.6 million more Americans left the workforce when compared to November of 2019, and 90% of that increase was from the 55+ age group. This trend was driven largely in part by folks within this demographic experiencing improved economic conditions, allowing them to retire early and/or explore other opportunities.

The other side of the labor shortage conundrum is that more people have changed jobs to more desirable opportunities, and companies are having a hard time keeping up. Employees are demanding higher pay and better work conditions, and therefore companies are being pressured into rethinking their compensation and benefit packages. It’s less about a lack of workers, and more about a lack of attractive jobs being offered by employers. This year we will continue to see successful companies innovate their offer packages to acquire top talent, while companies that do not follow this trend will suffer. We may also see an influx of 55+ professionals opt to re-enter the workforce, competing with younger workers for coveted job openings.

F. Predictions for 2022

Our prediction for the ARM industry throughout 2022 will be increased M&A activity, primarily as a result of consolidation – bigger companies acquiring smaller ones. Smaller ARM companies may struggle to both remain profitable and competitive in today’s market, as business costs associated with staff, insurance, regulatory compliance and technology continue to rise. In addition, the Fed has indicated that they expect interest rates to begin to rise again as early as Q1, placing added pressures on companies to find ways to become more cost efficient despite business performance uncertainty. However, we do anticipate placement volumes to begin to increase in 2022, but liquidations may lag until the economy stabilizes again, most likely toward the end of 2022 into 2023.

NOTEWORTHY ARM TRANSACTIONS

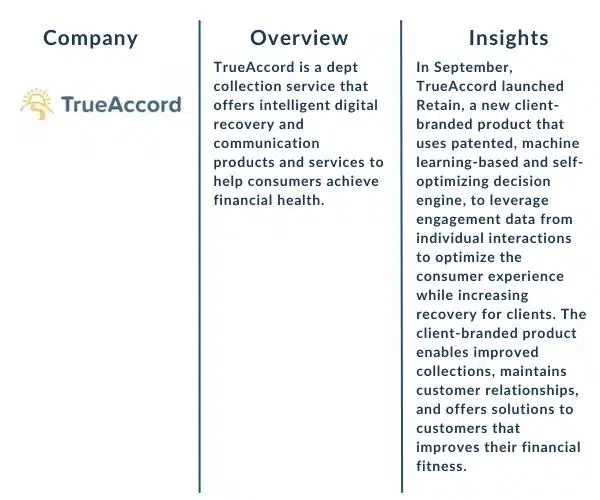

ARM COMPANY SPOTLIGHT