Delinquencies on the rise signaling a wholesale shift this upcoming year.

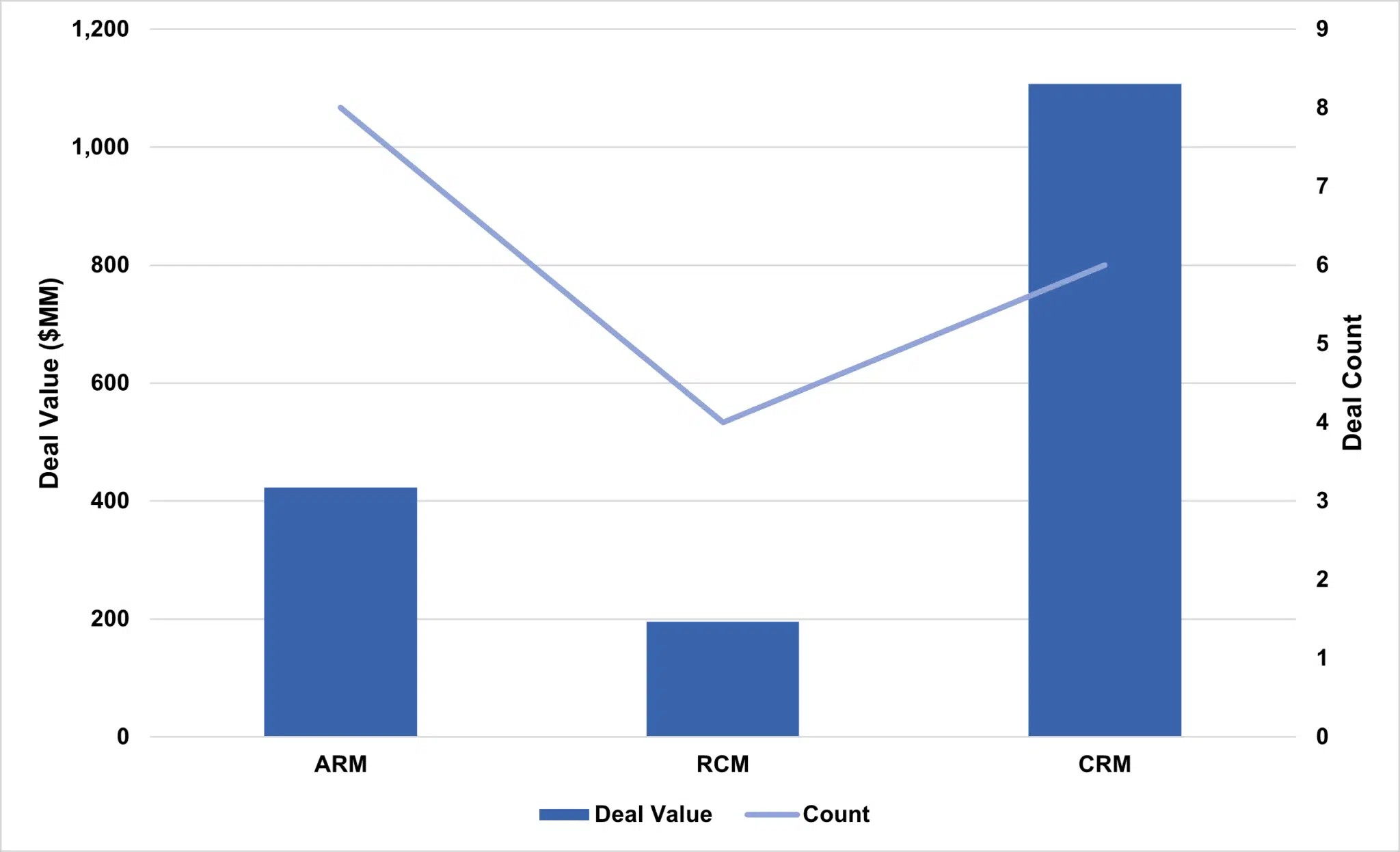

ARM Deal Value & Count for Full Year 2022:

Last year was a rollercoaster with the implementation of Regulation-F at the end of 2021. Decreased collections performance after COVID—in conjunction with the government stimulus—“pulled forward” years of performance as individuals cleaned up their personal balance sheets. As such, many agencies ended 2022 at an inflection point: to hold on and make the necessary capital expenditures to compete in the “new age of collections” or contemplate their next chapter.

This year will be a continuation of those trends we saw in the back half of 2022, with a focus on consolidation amongst smaller industry participants to acquire the tools/technology/knowledge to compete going forward. We are still in the early innings as it comes to consolidation but envision M&A activity to pace beyond what 2022 brought to us in the ARM vertical.

Given the variety of dynamics that unfolded over 2022—mainly inflation and non-zero interest rates showing up to the party—deal timelines extended beyond the traditional process agendas in prior years. We anticipate this trend to remain in place in 2023 as buyers evaluate deals with more scrutiny given the interest rate/debt service sensitivity increases.

In the student loan world—which has interesting dynamics of both campus/university based collections and the personal balance sheets of consumers—the Biden administration recently submitted its opening brief(s) to the Supreme Court regarding federal loan forgiveness. Oral arguments are expected to kick-off at the end of February.

If the plan is enacted, nearly $441B in student debt would be eligible for forgiveness. As it stands today, the forbearance order extends until June 30, 2023. But for all the suspense, this year feels like the final act of the student debt forbearance saga and we will be keeping a close eye as it begins to conclude.

2023 is also the likely end of the “wealth effect” of the housing market. Quickly rising interest rates and recessionary fears have cooled home values. With home equity values remaining flat or decreasing, consumers are likely to tighten up their spending and consumption.

Have you seen the price of eggs!?

Finally, delinquencies tracked by The Financial Brand—and charge-offs tracked by the Federal Reserve—are showing increases. This means Americans aren’t paying their debts again, and CAS predicts these delinquency rates will revert back beyond pre-pandemic levels.

As such, 2023 will likely be the year we finally see increased charge-off and delinquencies which will spell opportunity for debt purchase and increase collectable volume for agencies. Discover Financial Services reported a 76 basis point increase in net charge-offs comparing Q4 2022 to Q4 2021.

In fact, many of the largest financial institutions are boosting provisions for credit losses compared to prior years. The “Big Six,” including: JP Morgan, Bank of America, Wells Fargo, Morgan Stanley, Goldman Sachs, and Citi, all increased loss reserves significantly from $5.1B in Q3 2022 to over $7.2B in reserves as of Q4 2022.

While this pales in comparison relative to the $44.7B in provisions set aside in the first half of 2020 at the onset of COVID, it signals a reversal in the direction that the largest financial institutions had been taking.

Q4 2022 Noteworthy Transactions:

Meduit acquired JP Recovery Services*

Oliver Technologies acquired Lawgix Services

Symend recapitalization

*A CAS lead transaction